Kevin Carmichael: A joint public-private effort could mitigate the bleak future predicted by Bank of Canada models

Content of the article

We’re only two weeks away, but it looks like 2022 could be the year Canada’s business and political leaders finally take climate change seriously.

Advertising

This ad has not loaded yet, but your article continues below.

Content of the article

Getting serious this late in the game isn’t necessarily something to applaud, but as the saying goes: the best time to plant a tree was 20 years ago. The second best time is now.

One of the reasons to think that the dithering on climate change is about to end is that the federal banking regulator has warned the institutions it oversees to prove that they can be trusted to adapt from adequately to the financial risks posed by climate change. If they don’t, the Office of the Superintendent of Financial Institutions will do it for them by requiring them to keep more capital in their rainy day funds.

“The focus is on building a risk management infrastructure,” Ben Gully, OSFI’s deputy superintendent, told reporters during a virtual news conference Jan. 14. “We see this as appropriate and important because capital is no substitute for risk management, and we need to put risk management in place.

Advertising

This ad has not loaded yet, but your article continues below.

Content of the article

He added: “In the short term, it’s risk management. In the longer term, once this matures, we will enter the arena of the capital.

In other words, if larger financial institutions can convince OSFI that they are applying the same stringent climate risk standards that they apply to small business loans, they will likely be able to avoid onerous capital requirements. . The banks are being offered a window to deal with climate change on their own terms rather than those dictated by Ottawa. There’s every reason to think they’ll take it.

-

Omicron likely short-lived hit, but supply chains could suffer, Bank of Canada governor says

-

Jobs recovery bolsters case for an upcoming Bank of Canada hike

-

Macklem in year-end interview promises to curb inflation, but not stifle recovery

Advertising

This ad has not loaded yet, but your article continues below.

Content of the article

Make no mistake: the cost of capital for the biggest polluters will go up no matter what, and the economic impact will be significant because these polluters are the main drivers of the Canadian economy.

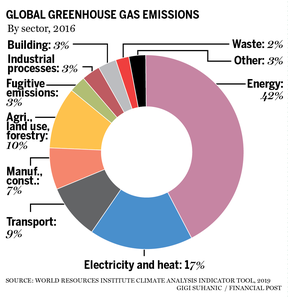

OSFI’s guidance on the direction of regulatory policy is based on joint research with the Bank of Canada showing that there is nowhere to hide from the effects of climate change. A model-based analysis of four possible scenarios of how things might unfold over the next 30 years – status quo; a slow response that will not meet current climate targets before 2100; a delayed response that requires catching up to meet current targets by 2100; and more vigorous adoption of net zero by 2050 – all concluded that industries such as oil and gas will have a harder time making money and economic growth in Canada will suffer.

Advertising

This ad has not loaded yet, but your article continues below.

Content of the article

“These are what-if scenarios,” said Toni Gravelle, deputy governor at the Bank of Canada, during the press conference. “The stronger the policy that would have to be put in place (to achieve the emissions targets), the stronger the catch-up policy to be put in place, the more the risk of transition would increase.”

Scenario analysis predicts the role the Bank of Canada and OSFI will play in addressing climate change in the future. The central bank has little regulatory power, but it is by far the most influential economic research institution in the country, and its work promises to become a neutral benchmark for environmental policy. OSFI, meanwhile, lacks the central bank’s ability to grab headlines, but it wields considerable influence on Bay Street as the overseer of Canada’s banking oligopoly.

Advertising

This ad has not loaded yet, but your article continues below.

Content of the article

The duo has the potential to become the center of gravity of the climate debate, since the most important discussions will inevitably start from the benchmarks set by Bank of Canada Governor Tiff Macklem and/or Chief Executive Peter Routledge. from OSFI.

Whether their respective work on climate change makes a difference will depend on the rest of us. Politics remains messy. For example, political champions in the oil industry are often more adamantly opposed to change than the industry itself. But the cartoon versions of the country’s political leaders who pop up on Twitter every day are more aligned in real life. Every major party endorsed some version of a carbon tax in the last election, and both Liberals and Conservatives said Canada needed an agency with the means to fund theoretical research on the biggest issues. of the world.

Advertising

This ad has not loaded yet, but your article continues below.

Content of the article

Climate change would be an obvious target for such an agency, according to an essay by Robert Asselin and Sean Speer, policy experts who served in the Liberal and Conservative governments respectively, published in the Financial Post on January 10. Both are influential with business leaders. and politicians: Asselin, who worked for former finance minister Bill Morneau and BlackBerry Ltd., is now policy officer at the Business Council of Canada, a leading association of business leaders; and Speer is the Scotiabank Strategic Competitiveness Fellow at the Public Policy Forum, a think tank with a board of directors made up of executives and senior government officials.

A joint effort by the public and private sectors could mitigate the bleak future predicted by Bank of Canada models. The central bank based its analysis on current technology because it is difficult to model human ingenuity. A technological breakthrough or two would turn the tide. Forces are gathering that could allow this to happen.

• Email: [email protected] | Twitter: carmichaelkevin

Advertising

This ad has not loaded yet, but your article continues below.