[ad_1]

LONDON (Reuters) – The misuse of climate models could pose a growing risk to financial markets by giving investors a false sense of certainty about how the physical impacts of climate change will play out, article authors say published Monday.

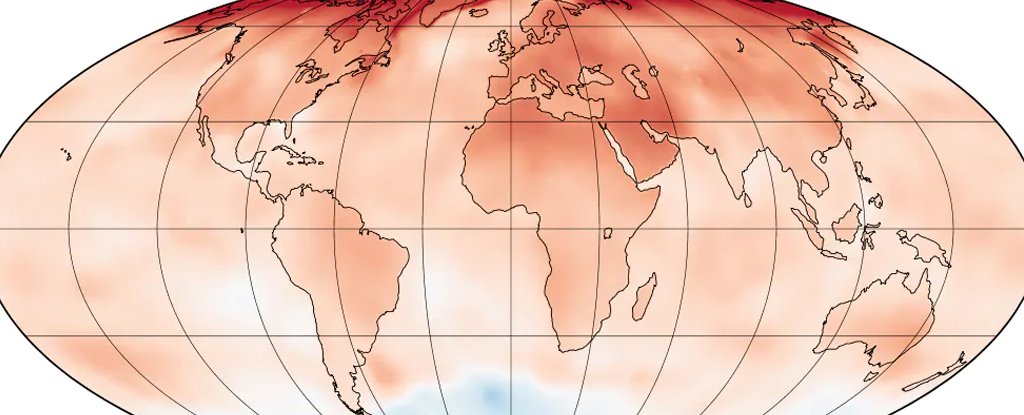

With heat waves, wildfires, massive storms and sea level rise set to intensify as the planet warms, companies are under increasing pressure to reveal how the disruption could affect their businesses. activities.

But the authors of a peer-reviewed article t.co/oVO3rI6YyT?ssr=true in Nature Climate Change warned that the drive to incorporate global warming into financial decision-making has overtaken the models used to simulate the climate. of “at least a decade”.

“In the same way that a Formula 1 Grand Prix car is not what you would use to go to the supermarket, climate models were never developed to provide accurate information about financial risk,†said Andy Pitman, climatologist at New York University. South Wales and co-author of the article.

Misuse of climate models could lead to unintended consequences, such as “green laundering” some investments by minimizing risks, or hurting the ability of companies to take on debt by inflating others, the authors said.

The problem is that existing climate models have been developed to predict temperature changes over decades, on a global or continental scale, when investors typically need location-specific analysis over much longer time periods. short.

Climate models are also not designed to simulate extreme weather events, such as storms, which can lead to sudden financial losses.

To bridge the gap, the authors called for the development of new forms of climate projection to support the financial sector, backed by trained “climate translators†to help regulators, investors and businesses make better use of science.

“Businesses like to use models because the numbers give them a sense of security,” said Tanya Fiedler, senior lecturer at the University of Sydney and lead author of the article. “That doesn’t necessarily mean the numbers are reliable.”

Reporting by Matthew Green; Editing by Hugh Lawson

[ad_2]