We hear more and more about net zero goals in recent years.

Since 126 countries signed the Paris Agreement at COP 21 in 2015, climate change has been high on the agendas of international governments. The continued finalization of the agreement at COP 26 at the end of 2021 in Glasgow saw a further strengthening of efforts.

Fintech is seen as playing an important role in achieving climate change goals. The UN has estimated that meeting climate change goals will require investing $90 trillion to create sustainable infrastructure by 2030. At COP 26, new funding pledges were made to help developing countries to achieve this goal.

Switch to a circular economy

An important factor forming part of the European Commission’s offer to create a more sustainable society is the development of a circular economy.

The European Green Deal has set out a blueprint for creating sustainable growth within the EU. He presented a plan to make Europe a “modern, resource-efficient and competitive economy”.

In addition to achieving net zero emissions, they focused on creating an economy that could achieve growth without it being relative to resource use.

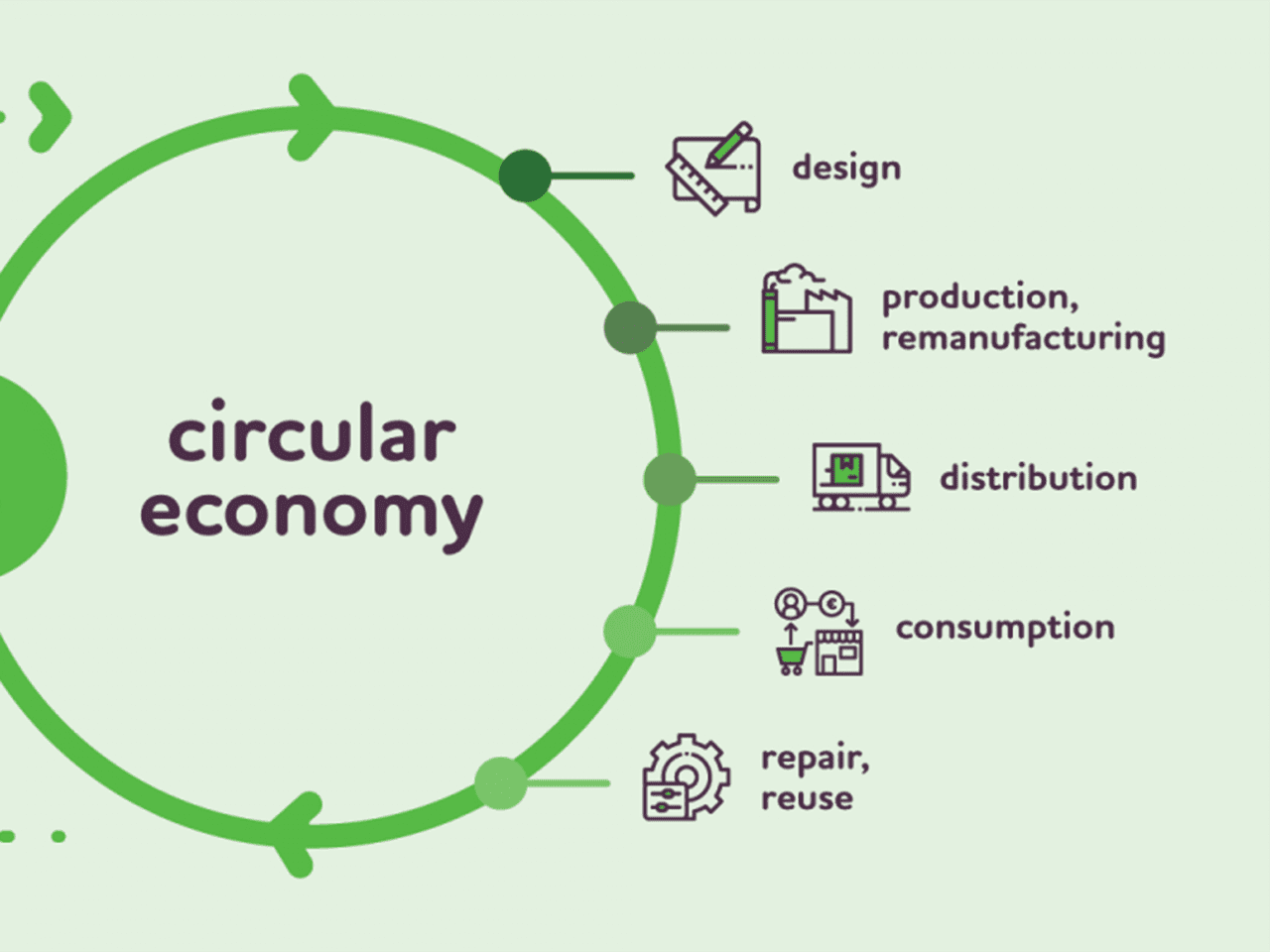

This goal led to the formation of the new Circular Economy Action Plan (CEAT). Measures would be implemented to, among other things, make sustainable products the norm and ensure less waste with the aim of leading global efforts towards a circular economy and reducing the pressure on natural resources.

In March and April 2022, they adopted various regulations consistent with this plan. This included the implementation of increased visibility regulations on corporate compliance with net zero targets and initiatives focused on the increased use of sustainable packaging and reusable products.

The term “circular economy” refers to the cycle of reusing objects and where they would traditionally be thrown away. It offers an alternative to the traditional “linear economy” which has been the general rule over the past decades. The “take, use, throw away” consumer mentality.

According to the World Economic Forum, in 2019 more than 92 billion tons of materials were mined and processed, contributing half of global CO2 emissions. On top of that, the wastes from this continuous cycle of manufacturing and disposal, plastic, food, textiles, etc., cause their own detrimental effects on the global ecosystem.

The circular economy model has the potential to generate $4.5 trillion in economic benefits by 2030; however, currently only 8.6% of the world operates this way.

Increase in targeted businesses

The company’s commitment takes place at several levels. The Twig Group is one of many companies working to make the circular economy more accessible to consumers.

When opening an account with their mobile banking solution, TwigPay, customers can download the items they want to trade, instantly crediting their account with the equivalent value to make purchases. The articles are then sent to Twig.

The company has already won several awards and has partnered with several platforms to streamline its service. The most recent addition to the platform is their partnership with Mobi Market, reported as a strategy to bolster its circular payments proposition.

Mobi Market is one of the fastest growing online marketplaces for used mobile phones in Europe and has significant relationships with insurance companies and associated network providers.

Geri Cupi, Founder and CEO of Twig, comments: “We are delighted to welcome Mobi Market and its team to our Twig ecosystem. We look forward to joining forces to bring another dimension to circular economy services and delight our customers.

According to various studies, the main user group of the company currently consists of GenZ and Millennials, the sector most concerned with sustainable practices.

In a study conducted by the United Nations Development Programme, it was found that 65% of people aged 18-35 considered climate change an emergency, with an even higher percentage of children under 18 years. Much of their product offering is aimed at catering to this demographic, and they plan to expand into Web3, although there are few details as of yet.

Finance and circular economy

By directing funds to initiatives and companies that support the model, finance can support the creation of a circular economy.

However, in addition to creating a thriving circular economy for global benefit through sustainable growth, the model is also seen as creating an investment opportunity.

According to a study by Bocconi University of more than 200 European companies in 14 sectors, the more circular a company, the lower the risk of default.

The analysis found that adopting circular practices can reduce risk and increase resilience through better anticipation of stricter regulation and changing customer preferences, improved environmental impact and creation of a capacity for growth without it being linked to an increased use of resources.

More and more businesses are turning to the circular model to improve long-term growth and risk resilience.

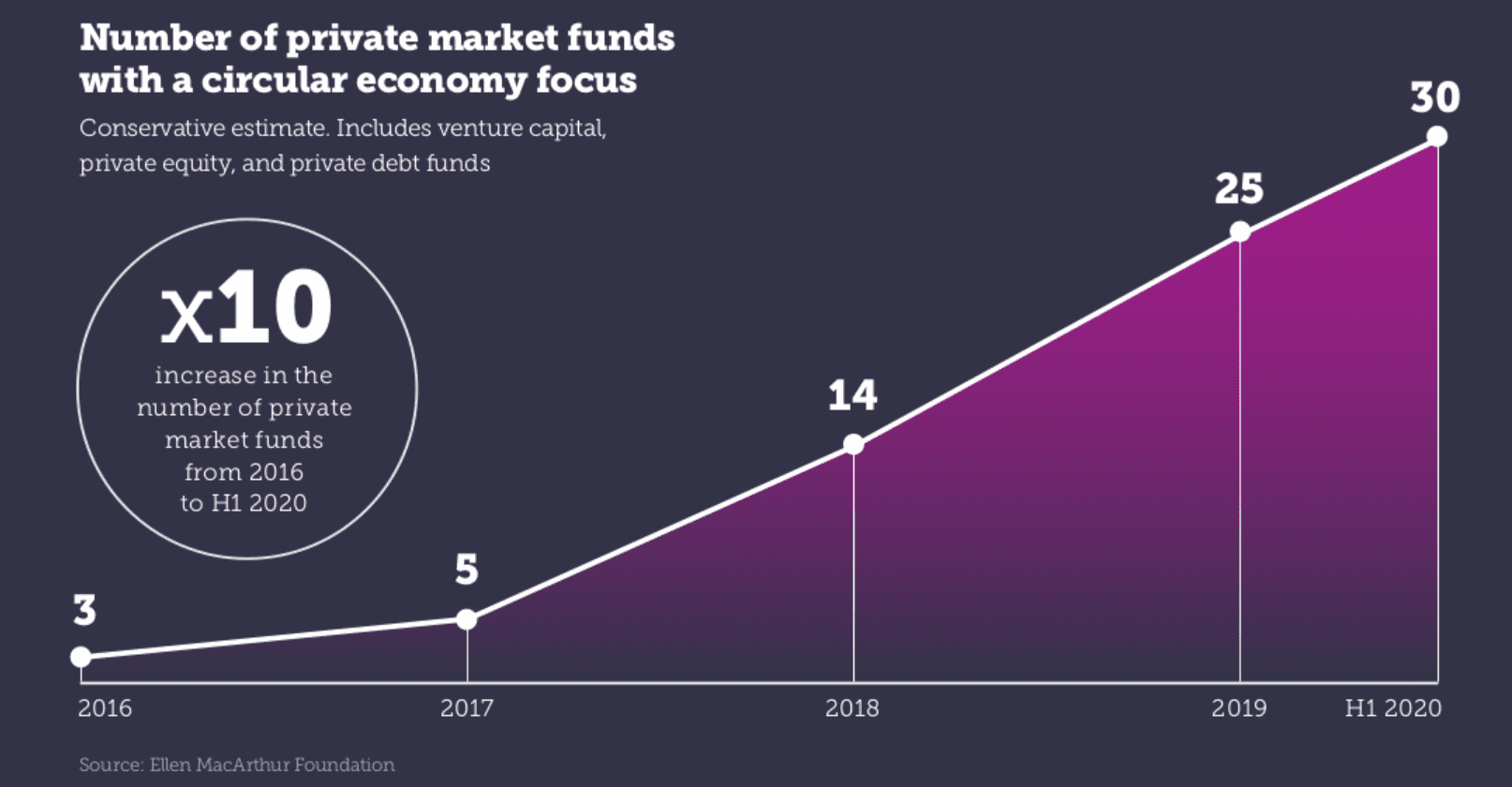

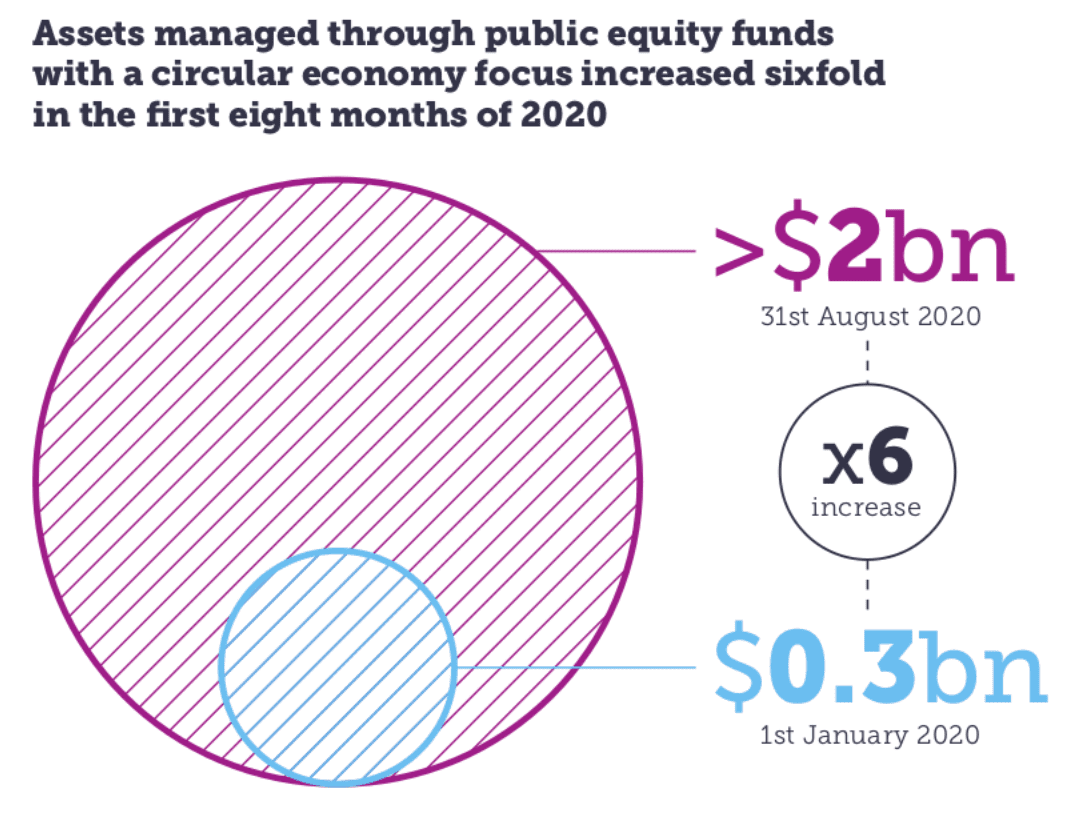

There has been a significant increase in debt and equity instruments created for this purpose over the past two years. At the end of June 2021, 13 public equity funds focused on the circular economy, with an asset value totaling $8 billion under management since 2019. In addition, more than 35 corporate and sovereign bonds have been issued for help fund circular economy activity.

BlackRock’s institutional asset manager has increased its investments in companies with a circular model over the past few years, creating a fund in October 2019 with this objective.

Paul Bodnar, Global Head of Sustainable Investing at BlackRock, said: “If you are an investor focused on long-term value creation and live on a planet with limited resources, you have a vested interest in the circular economy.

Larry Fink, CEO of BlackRock, agreed: “The concept of circular economy is so important. It’s a good way to invest, not just for social reasons, not just for environmental reasons, but for investment reasons, performance reasons.

They are not alone. ING has committed $118 million to scale-ups that have a positive environmental impact in areas such as the circular economy. Lloyd’s Bank has set up its $2.6 billion Clean Growth Funding which offers discounted loans to SMEs with a “green goal”, including circular businesses, among many others.

A report by the Ellen MacArthur Foundation, a leading organization in circular economy support and research, showed that nearly 600 companies, including 130 with over $1 billion in revenue, have started to measure their progress in the circular economy.

- About the Author

- Latest posts

Isabelle is a creative project manager and freelance journalist with an honors bachelor’s degree in architecture and a master’s degree in photography and visual media.

With over five years in the art and design sector, Isabelle has worked on a variety of projects, writing for property development magazines and design websites, and managing art industry initiatives. She has made independent documentaries about artists and the esports industry and was involved in the production of BBC Two’s Venice Biennale: New British Voices.

Isabelle’s interest in fintech stems from a desire to understand the rapid digitization of society and the potential it holds, a topic she has addressed many times throughout her academic pursuits and career. of a journalist.